What is Territorial Tax?

Territorial tax countries can work just as well for some people as tax havens. In this article, we’ll explore the pros and cons of territorial tax countries.

Introduction

Are you intrigued by the complex yet fascinating world of taxes and finance? Or perhaps, you’ve heard the term ‘territorial tax country’ and are on a quest to understand its meaning and implications? In this comprehensive article, we’ll demystify the concept, delve into its details, and explore its impact in the realm of global finance. Let’s dive in!

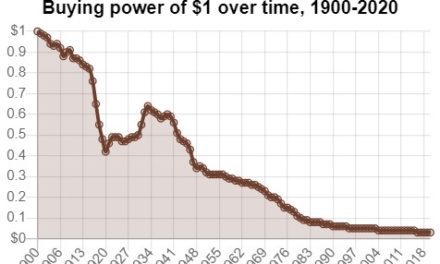

An In-depth Look at Taxes

Before diving into the intricacies of a territorial tax country, we need to lay the groundwork and understand the taxation basics.

Understanding the Concept of Tax

Generally, a tax is a mandatory financial charge or some other type of levy imposed upon a taxpayer by a government to fund public expenditures. It’s a pivotal source of revenue for governments, helping fund infrastructure, public services, and various governmental functions. It also funds welfare, war and other destructive programs.

The Territorial Tax System

Now that we have a basic understanding of taxes let’s focus on this article’s core topic – the territorial tax system.

At its core, a territorial tax system is a type of tax system where only the income earned within a particular country’s borders is taxed by that country. In other words, foreign-source income — income earned outside the country — is not subject to domestic tax.

Key Features of a Territorial Tax System

The taxation rules in a territorial tax system are pretty straightforward and respect territorial boundaries.

If a resident of Country A, for instance, earns income in Country B, then Country A will not tax that income. If any tax liability exists, it will be in the country where the income was earned. No tax will be due in the country of residence.

Delving into Examples of Territorial Tax Countries

A number of countries around the world have territorial tax systems.

Examples of territorial tax countries include Hong Kong, Singapore, and Costa Rica. These countries only tax income that is sourced domestically.

Exploring the Mechanism of a Territorial Tax System

So, how does this system operate in reality? To comprehend this, let’s look at a hypothetical scenario.

Imagine you’re a resident of Hong Kong, which has a territorial tax system, but you generate passive income in the United Kingdom. In this case, you would have no tax liability. The UK would not tax you as you’re not a resident. Hong Kong would not tax you as you have no income there.

Analyzing the Pros and Cons of a Territorial Tax System

Like any other system, the territorial tax system has its own advantages and disadvantages.

Key Advantages

The primary advantages of a territorial tax system include encouraging foreign investment and preventing the incidence of double taxation. We’ll cover double taxation in more detail later.

Potential Disadvantages

On the downside, a territorial tax system can sometimes pave the way for base erosion and profit shifting (BEPS), a tax planning strategy used by multinational companies.

A Comparative Analysis: Territorial Tax System vs Global Tax System

A comparative study can offer better insights into how a territorial tax system stands against a global tax system.

While a territorial tax system taxes only domestic-source income, a global tax system, as followed by the United States, taxes its residents on their worldwide income. Each system has its own unique implications and effects on global finance.

Understanding the Implications of a Territorial Tax System

A territorial tax system can have significant implications, which can vary for businesses and individuals.

For Businesses: A Detailed Analysis

From a business standpoint, a territorial tax system might provide significant savings on taxes by allowing businesses to strategically place their headquarters in territorial tax countries.

For Individuals: What Does it Mean?

From an individual perspective, a territorial tax system could mean potentially lower tax liabilities depending on where they earn their income and their country of citizenship.

Decoding Double Tax Treaties

Double tax treaties (DTTs) are a crucial element in the world of territorial taxation.

These are essentially agreements between two countries that aim to eliminate the issue of double taxation—when the same income is taxed in two different jurisdictions.

Conclusion: Recap and Final Thoughts

The concept of a territorial tax country is a significant one in the context of global finance. Whether you’re an individual or a business, comprehending how different tax systems function can help you make more informed and strategic decisions regarding your finances.

Territorial Tax Countries in Latin America

What exactly is a territorial tax country?

A territorial tax country follows a territorial tax system, taxing only the income sourced within its own borders.

How does a territorial tax system work in practice?

In a territorial tax system, only the income that is earned within the country’s borders is subject to tax. Foreign-source income is not taxed.

Can you provide some examples of territorial tax countries?

Some examples of territorial tax countries include Hong Kong, Singapore, and Panama.

How does a territorial tax system impact businesses?

From a business standpoint, a territorial tax system might allow for significant tax savings, especially if businesses strategically place their income-earning activities in territorial tax countries.

What does a territorial tax system mean for individuals?

For individuals, a territorial tax system could potentially mean lower tax liabilities, depending on where they earn their income.