Oversharing Landed Fashion Boss in Jail

Offshore structures can be complex. It takes time, money, and planning to construct the ideal offshore setup. But all that effort can be for nothing when privacy is not respected. It’s perhaps the most overlooked detail for those with offshore structures.

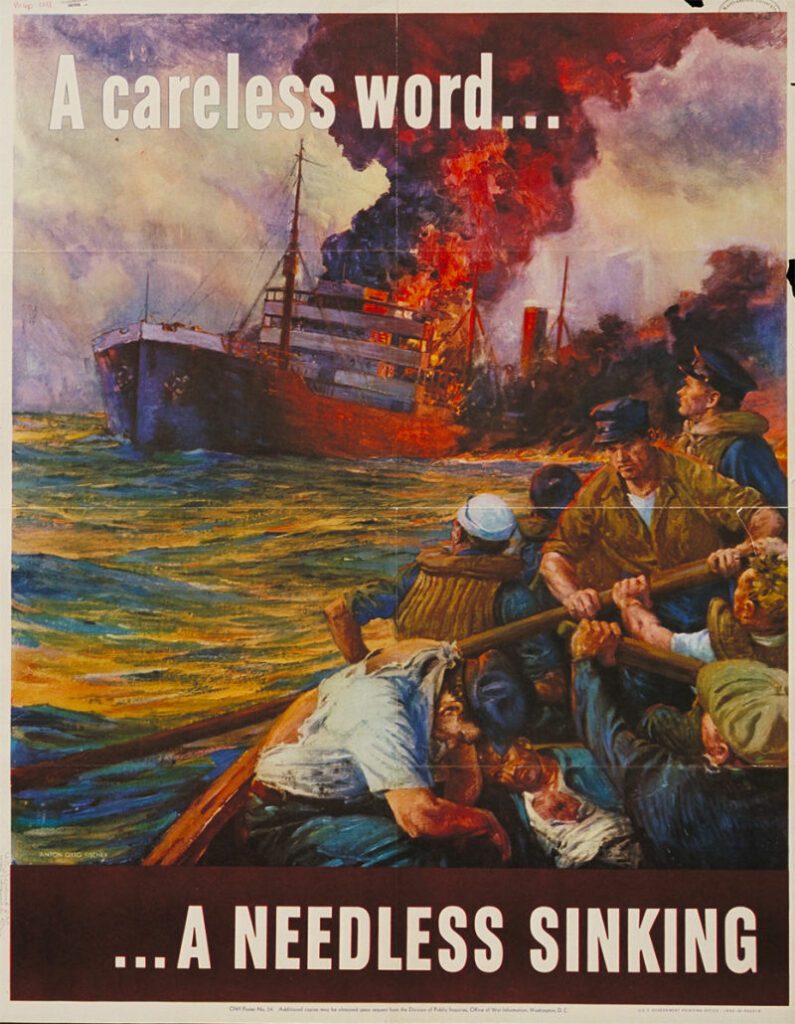

The phrase loose lips sink ships was coined during the Second World War. It was part of an advertising campaign by the War Advertising Council in 1942. The poster below is one of the billboards they used. The campaign was designed to discourage people from talking or writing about information that may inadvertently help the enemy.

The same care needs to be taken when speaking about your offshore structure. The enemy, in this case, may be the government, an ex-spouse, or any other predator who wants to get their hands on your money.

How a Fashion Boss Ended up in Prison

Most of us are familiar with the upscale fashion brand Gucci. What you may not know is that former boss Aldo Gucci’s clever offshore tax avoidance scheme was unraveled because he overshared confidential details with those closest to him.

Gucci set up a scheme that was almost foolproof. He set up a company in Hong Kong. The role of this company was to design new products and conduct market research. It would then sell the designs and research to other companies overseas. In return for carrying out these activities, the Hong Kong company would receive 10% of the gross income of the American company.

This income would be completely tax-free in Hong Kong. The substantial amounts of cash paid to the Hong Kong company from Gucci US would also reduce the taxable profits of the US enterprise. Gucci accumulated substantial funds well beyond the reach of the IRS.

This scheme worked perfectly for more than 15 years. It even survived an IRS audit.

So what went wrong?

As is so often the case, Gucci was brought down by those closest to him. He disclosed much more about the offshore structure to family members than they needed to know. Gucci was turned in by his own kids in a family battle over money.

His family told the IRS the name of the company in Hong Kong. They informed them where the company banked. They also disclosed the names of the Panamanian corporations that owned the shares in the Hong Kong company.

Gucci’s Offshore Structure was Sunk

With this information in hand, the US government was able to demand bank records in Hong Kong. They also discovered that the Hong Kong company had never done much design or research work. It had, in fact, never sold anything. The design work was carried out by Gucci employees in New York.

Gucci was criminally charged, as the Hong Kong company was just a front. He ended up being sentenced to just over a year in prison at 81 years old.

The IRS could never have worked all this out by themselves without the help of Gucci’s family. The scheme wouldn’t even have been illegal had it operated correctly.

But Gucci’s loose lips sank him. He told people he believed he could trust far too much.

It’s often never our enemies that cause us the biggest problems. It’s the envious friends; it’s an ex-spouse or a disgruntled employee. That’s why it’s essential to disclose sensitive information only on a need-to-know basis.

Conclusion: Silence is Underrated

It’s never a good idea to tell anyone about your overseas bank accounts or assets.

It’s obvious that you should never keep information on your overseas assets at home or in your office. Any information on your computer should be encrypted with a very long passphrase.

You should never leave yourself exposed to someone with too much information about your business being in a position to ruin you. Ironclad asset protection structures are available to everyone. But, they can always be undermined by careless talk and bad implementation.