International Business Companies

International Business Companies or Offshore Companies tend to be the best type of structure for strong asset protection. They also provide strong privacy protections and have fewer filing requirements compared to onshore jurisdictions. Using this type of company for day-to-day trading can be more difficult. It can be more challenging to set up facilities with counterparties such as brokers and payment processors.

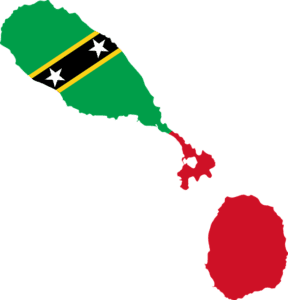

Nevis

Set up a company in Nevis for some of the strongest asset protection laws available. Foreign judgments are not recognised.

Set Up Costs: €1,000 – Buy Now

St Vincent

St Vincent is a Caribbean Island with a population of 103,000. St Vincent has strong financial privacy laws that protect against the disclosure of your confidential information to foreign authorities. You can keep your affairs private as there’s no public register of directors or shareholders. Bank accounts can be opened here without an in-person visit making it an ideal jurisdiction for offshore banking. Bearer shares are still available in St. Vincent, although the owners must be disclosed to the local agent.

Set Up Costs: €1,350 – Buy Now

Marshall Islands

Set up a company in The Marshall Islands for high levels of privacy. It’s one of the few jurisdictions where bearer shares are still available. There are no taxes for companies trading outside The Marshall Islands.

Set Up Costs: €1,250 – Buy Now

Brunei

Brunei is not so well known as other offshore jurisdictions. That should not stop those looking to set up a company here. It offers fast incorporation times and good levels of privacy. Filing requirements are limited. Banking options are good.

Set Up Costs: €1,500 – Buy Now

Panama

Panama is the best offshore jurisdiction in Central America. Panama does not disclose information under MLA treaties for normal business. When you set up a company in Panama you will not pay any corporate taxes on profits generated outside Panama.

Bahamas

The Bahamas are the most solid and most reputable option in the Caribbean to set up a company. IBCs are tax-free and offer high levels of privacy.

Set Up Costs: €2,150 – Buy Now

Costa Rica

Costa Rica offers similar benefits to Panama. It’s more unusual to set up companies in Costa Rica for offshore use. No licenses are needed for gambling when you set up a company in Costa Rica.

Set Up Costs: €1,700 – Buy Now

European Limited Companies

Bulgaria

Bulgaria has a 10% flat tax when you set up a company here. It also has low administration costs. There are good banking options in Bulgaria. For trading in the EU, particularly if you need VAT registration, Bulgaria is a good option.

Set Up Costs: €1,000

The Netherlands

The Netherlands offers attractive options for holding companies. It can also be useful for intellectual property owners to set up a company here. Easy bank account opening with major international banks.

Set Up Costs: €1,300

United Kingdom

Set up a company and be trading the same day. Good banking options. UK companies can be set up cheaply and with a minimum of red tape.

Set-Up Costs: €150

Slovakia

Another decent option to set up an EU company with VAT registration. Efficient registrar and low taxes.

Set Up Costs: €950

Lithuania

Lithuania has low taxes for micro-companies with sales below €200,000. When you set up a company in Lithuania you can take advantage of easy bank account setup and EU vat registration.

Set Up Costs: €500

Ireland

Ireland has one of the lowest corporate tax rates in Europe at 12%. In reality, you should be able to pay a much lower rate. Good options are available for banking and nominees. See our Ireland package here.

Set Up Costs: €2,995 including bank account and nominees – Buy Now

North American Limited Companies

Canada

Tax-free trading for business outside Canada. Easy to establish relationships with banks and other counterparties. Many good banking options.

Set Up Costs: €2,500

Wyoming

Tax-free US company for those seeking access to US payment providers and banks.

Set-Up Costs: €500

Delaware

Set up a company in Delaware to take advantage of US banking and payment providers.

Set Up Costs: €500

Limited Partnerships

United Kingdom

UK LLPs offer the advantage of a UK corporate structure and are completely tax free when the partners are resident outside the UK. See our article on UK LLPs here.

Set Up Costs: €500

Denmark

Denmark LLPs offer exemption from taxes in Denmark combined with excellent banking options.

Set Up Costs: €5,750

The Netherlands

When you set up a Netherlands LLP you can take advantage of tax free trading and a credible corporate structure for trading worldwide.

Set Up Costs: €5,900

Middle East and Asia

Hong Kong

Hong Kong has all the advantages of a dynamic Asian economy but with a British legal system. Find out how to use a Hong Kong company for tax free trading here.

Set Up Costs: €1,700 – Buy Now

Singapore

Set up a Singapore company and be based in a jurisdiction with an excellent reputation, top rate banking options and low taxes.

Set Up Costs: €5,000

Malaysia

Set up a Company in Labuan, Malaysia and you will enjoy a fixed tax rate of only 3%. Cheaper costs than neighbouring Singapore.

Set Up Costs: €3,250

United Arab Emirates (Free Trade Zone)

Set Up a Company in the UAE and use it to get a tax free residency. Both you and your company will be tax free anywhere in the world. A good choice of banking options are available too.

Set Up Costs: €4,000

We can set up companies in any jurisdiction worldwide. Let us help select the best jurisdiction for you based on your individual goals, whether that be lowering your tax rate,moving your residency or protecting your assets. Get in touch with us by clicking here.