Avoid CRS By Implementing One of These Strategies

The Common Reporting Standard (CRS) was implemented by the OECD to end privacy with overseas bank accounts. Fortunately, it’s not very effective. The rules are full of loopholes. If you present the overseas bank with the right information when you open your account, you can easily avoid CRS. If you follow the guidelines in this article, you can avoid CRS and gain more privacy in the process.

There are a set of agreements for banks to exchange information about your accounts with the tax authorities in your home country. Generally, how it works is that the country where your banking will be obliged to send details of your account to the finance department in their country. The country’s finance department will then forward the account information, including the balance, to the tax department of whatever country you are resident in.

However, like many government policies, it is just as likely to cause chaos and confusion and end up with people taking action to defeat it. Would you rather keep your financial affairs private and avoid CRS completely? Read on……

Here are nine ways that you can avoid CRS:

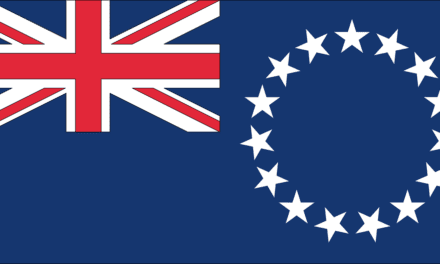

1. Bank in a Country that is Not Signed up to CRS

There are still over 100 countries that do not share information under CRS. In Europe, for example, Serbia and Armenia will not share information.

Perhaps the most surprising country not part of CRS is the United States. Provided you’re not a US citizen or resident, you can have a Company in Wyoming or Delaware and operate it privately without information being automatically exchanged. That being said, the USA is not the place to bank for anybody seeking privacy.

2. Move Your Tax Residency to a Tax Haven

If you move your residency to a tax haven, your overseas bank will send the information there.

If you are a UK citizen with residency in Monaco or Dubai and therefore have a zero tax rate, you will not be too concerned about your bank in Bermuda sending your details to Monaco.

Some jurisdictions, like The Cayman Islands, will send information to foreign countries but opt not to receive any information on their citizens or residents. These are called Voluntary Secrecy Countries.

3. Keep Your Money in a Trust

If your money is held in a trust, you can avoid the exchange of information with a structure where the true beneficiaries remain anonymous. You can find out more about trusts and foundations here if you’d like to avoid CRS by using a trust.

4. Business Accounts in Existence Before CRS are Excluded

If it is a Corporate account that was in existence before 2016 and the balance is less than $250,000, no information will be exchanged under CRS.

5. The Account Balance is Reported on One Date Every Year

The account balance is only reported on 31st December every year. You could transfer cash out of your account before that date and send it back afterward. In that case, only a zero balance would be reported to your home tax authority. This is a bit of a cumbersome process to avoid CRS, but it works.

A structure could be put in place where there are five shareholders with 20% each. In that case, nothing would be reportable. CRS only applies to those shareholders having more than a 25% shareholding.

7. Companies with Operations are Not Disclosed

If your company has an operating business, then it is not reported. CRS is only for financial investments. If the Company is operating a real business, nothing can be disclosed. It’s easy to convince the bank that you have an operating business.

8. Companies Listed on a Stock Exchange are Excluded

If the Company is listed on a recognized stock exchange, it is excluded from being reported under the Common Reporting Standard.

9. Get a Taxpayer ID from another Jurisdiction

It’s easy to get a taxpayer ID from most jurisdictions. After all, they want new customers. You can get a taxpayer ID from either a non-CRS country or a country where you don’t mind if they receive information from your overseas bank. If, for example, you got a taxpayer ID from Portugal but had no assets or income there, you may not care if Portugal receive your information instead f your home country.

As you can see, there are many potential ways around CRS. It has to be planned and structured properly. I am constantly surprised by how few people are even aware of CRS.

If you have existing overseas accounts that you’d rather keep private, you should take action without delay.

Liberty Mundo can help you open bank accounts and get overseas residences and second passports. You can legally avoid most taxes and become a citizen of multiple countries. Our mission is to work with you on a viable Plan B to minimize your taxes and ensure you have a safe haven to go to if needed.

Click here to contact us to find out more.

How do you evade CRS?

CRS can be avoided by moving your primary residence or moving your overseas bank accounts to countries that aren’t part of CRS.

What is the meaning of CRS?

CRS stands for the Common Reporting Standard. It’s a charter for snoopers and abolishes banking privacy in many countries, including the most popular tax havens.

Who is exempt from CRS reporting?

Operating businesses, certain trusts, and individuals who own less than 25% of a company. CRS is full of loopholes.