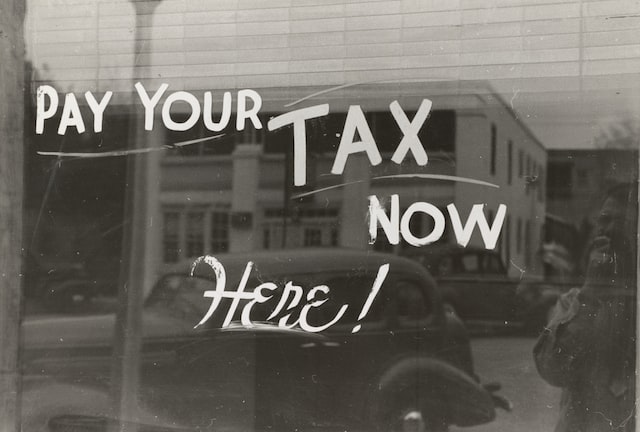

Many consider income taxes to be a necessary evil. They are not. They’re a relatively modern phenomenon. They were introduced in the US in 1913. Back then, they were only for those earning more than $3,000 per year, and they were taxed at the rate of 1%. This increased to 6% for those earning more than $500,000 per year. Only around 3% of the population was liable to pay income taxes at that time.

There’s no doubt in my mind that taxation is theft. Income taxes are not a necessary evil. They’re not necessary at all. Whatever side of the argument you’re on, income taxes are highly immoral.

Income Taxes Provide an Entry Point for the State to Look into Your Private Life

The fact that income taxes exist gives the state the opportunity to look into your private life. Without income taxes, the state would have no excuse to investigate how you live. It wouldn’t have to know where you work or where you spend your money. It wouldn’t have to know who your spouse is. The fact that income taxes exist gives the state an excuse to intrude on your life.

All Financial Privacy Vanishes

As long as income taxes exist, financial privacy cannot exist. The government can look at all your financial accounts whenever it wants. This can often be done without a warrant. It can also look at the accounts of anyone who sent you money. So, even someone not under any kind of government investigation can have their financial privacy violated for sending a payment to the wrong person.

Discover How to Make Your Assets Untaxable and Untouchable

Too Much Power to the State to control the economy

A true capitalist society can never exist as long as there are income taxes. Central planners in government set the rates of tax. They provide loopholes for the politically connected. They adjust rates to stimulate the economy. Tax rates can be reduced to stimulate demand or increased to reduce demand. A country that does this can’t be said to have a truly capitalist economy.

Income Taxes Give petty bureaucrats power over you

Petty bureaucrats that work with tax authorities such as the IRS and HMRC have way too much control over your life. The kind of people who work for tax authorities are generally lazy and unmotivated. They make frequent errors. Those errors can be very expensive, even ruinous, on some occasions. Tax authorities often have the power to remove money from your bank accounts automatically. In the US, they can refuse to renew your passport if you owe more than $50,000 in taxes.

The Compliance Costs – Time & Worry

Income taxes not only steal your money. They rob you of your time too. People spend massive amounts of time keeping records and filling forms to satisfy the government’s demands. Every year the forms get more complex and take longer to fill in. The penalties for non-compliance or making errors are very serious.

Rates Change Arbitrarily – Governments can’t generate income honestly

Governments don’t generate income like businesses do. Businesses have to provide a product or service that people want at a fair price. If they fail to do that, they’ll go bankrupt. Governments face no such pressures. It’s universally accepted that all government services are lousy and inefficient. The problem is it’s not possible to get a passport or driver’s license anywhere else. We’re all forced to deal with them. They’re able to arbitrarily increase their prices. This is enforced at the point of a gun. We’re forced to deal with them and forced to comply when they adjust their prices with higher tax rates.

Money Collected Pays for Immoral Things

When they get your money, it’s often spent on immoral things. Governments have murdered millions of people through wars. They incarcerate people for victimless crimes. Billions are wasted on destructive activities. Not to mention the outright fraudulent behaviors of some government officials and bureaucrats. The things that the state spends your money on are another reason why income taxes are highly immoral.

Damage the Most Productive People Most

The most productive people who earn the most are penalized most by income taxes. Anybody with substantial income generates this by providing value for his services. A productive individual will invest much of his profits back into his business so he can provide his products to a wider audience. The more money the state steals from the productive, the less value they can provide to others. This damages the whole economy by transferring resources from the productive to the unproductive.

The Vast Amount of Data Collected Isn’t Safe

Governments are incompetent at everything they do. They simply can’t be trusted to safely hold vast amounts of data on every individual in the country. Anybody who has access to this data, including employees of tax authorities, can use it for nefarious means.

Conclusion

It’s beyond question that income taxes are immoral. Much smaller governments exist to this day that are funded entirely by consumption taxes. Countries with no income taxes include Qatar, Monaco and The Cayman Islands.

Everyone has a moral duty not to fund the evils of the state. This can be done by moving yourself physically to a jurisdiction with no taxes. If that’s not possible, you should take every legal measure possible to avoid funding governments.

What is the meaning income tax?

It’s a tax based on how much you earn. The more you earn the higher tax rate you pay.

How much of your income do you pay in taxes?

This varies depending on the country and the state within the country. Rates vary from as low as 10% to over 50%.

What percent of income is taxed?

In most countries all amounts over an initial threshold are taxed.

Which states have no income tax?

Only 8 states in the US have no state income taxes. They are: Wyoming, Washington, Texas, Tennessee, South Dakota, Nevada, Florida and Alaska.