Massive Financial Databases on Taxpayers are Being Set Up Using CRS Information

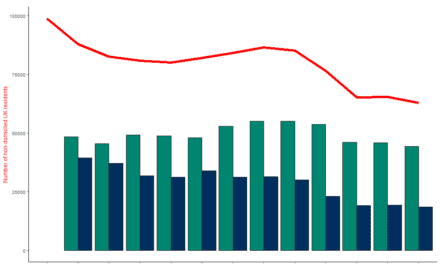

Tax authorities worldwide are receiving massive amounts of data due to CRS. The Common Reporting Standard (CRS) obliges banks and other financial institutions to report details of the account balance and interest payments to the clients country of residence.

Governments Overwhelmed by Volume of CRS Data – HMRC Sets a Tax Trap

The UK’s tax authority, HMRC claim they’ve received an unprecedented amount of data on taxpayers. They have been sending out letters to taxpayers (who they bizarrely refer to as customers) asking them to sign a declaration confirming that their tax affairs are in order. This is a trap for anyone who has an overseas account and hasn’t declared the income.

Anyone signing that document when HMRC is sitting on CRS information about their offshore accounts will face serious issues.

Penalties for non-disclosure in the UK can be as much as 300%.

This is happening in every country that’s signed up to CRS.

Time Limits for Tax Investigations Increased

Countries are receiving so much confidential data on taxpayers that they’ve extended time limits for investigations. In the UK the time limit for tax investigations was extended from 6 years to 10 years. Where fraud is suspected it’s been increased from20 years to 24 years.

Just because you haven’t heard from your local tax authority about your overseas account yet doesn’t mean you’re never going to be contacted.

Offshore Company Owners Targeted Too

Many people mistakenly believe that this doesn’t affect them if they have overseas accounts belonging to companies. This is not correct. It applies to beneficial owners of companies. It also applies to beneficiaries of trusts.

If you have overseas accounts in CRS jurisdictions you should make sure you’ve taken action so that your accounts aren’t disclosed to your home tax authorities.

If you’re considering opening an account overseas you should make sure that it’s set up so that it won’t be reported under CRS. This can be done by having a residency in another country. You can also set up an account in a non-CRS country.

Governments Want More of Your Money

With the global financial crisis gathering pace all governments are looking for ways to increase tax compliance. CRS has given them huge amounts of information to go after potential tax evaders. Even those that don’t have overseas accounts but have unexplained income in bank accounts in their home countries will face increased scrutiny. Governments everywhere face higher interest rates on massive debts, together with reduced tax income. They are coming after tax avoiders harder than ever.

Take Action Before it’s Too Late

It’s ever more important to take active measures to keep your financial affairs confidential. Simply opening a bank account in Switzerland and using your home address doesn’t work anymore.

Setting up an offshore company and declaring yourself as the beneficial owner and director while staying in a high tax country doesn’t work either. There are solutions available. Solutions that allow you to keep your financial affairs private. I’ve outlined some of the strategies we use with our clients in BulletProof Asset Protection. I also work directly with private clients to make sure their finances remain immune from the threat of money grabbing tax departments.

The bottom line is that anyone, even with modest wealth, needs to take action to protect it. Tax authorities go after the low hanging fruit first. This is often hard working people with modest amounts saved. It’s more important than ever to know the pitfalls to avoid falling into any tax trap set by your government.

Need help to avoid a tax trap? We have decades of experience of helping high net worth clients legally avoid tax by setting up overseas structures. We can help you set up overseas structures in a way that won’t be reported to tax authorities. We also help set up second residencies and passports. Get in touch here.