How You Can Take Advantage of Internationalisation for Tax Minimisation

Take Advantage of Tax Havens

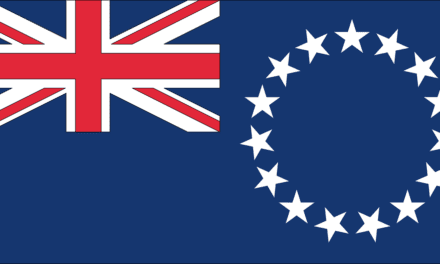

In order to achieve real tax minimisation, the best strategy is to move to a tax haven. Those living at least 6 months per year in tax havens like Monaco and The Cayman Islands pay no income tax whatsoever. There’s no better tax minimisation strategy than having a zero-tax rate.

Don’t worry if you can’t move to a tax haven though. We have plenty of other tax minimisation strategies below.

Set up an Offshore Company

If you’re unable to relocate to a tax haven why not set up a company located in a tax haven. This can be an excellent tax minimisation strategy. It’s not quite as simple as setting up an offshore company and directing all of your income through that vehicle. Your strategy needs to be thoroughly planned. It’s important that you don’t fall foul to CFC rules (Controlled Foreign Corporation Rules). Most high tax countries have CFC rules to discourage people from using offshore companies. However there are many strategies to avoid CFC rules.

Have a Trading Business Overseas

If you can have a trading business overseas, you have opened a new world of tax minimisation options. A trading business is an actual business with operations and employees. It should have a physical presence in either a tax haven or a country with low corporate taxes. A trading business is not subject to CRS rules. The overseas company can legally get funds to you that are not classed as income and therefore not subject to tax in your country.

Store Gold Overseas

Precious metals can be used as part of a tax minimisation and asset protection strategy. Gold, stored overseas is not as easy to seize as bank accounts are. It’s also not reportable to the tax authorities of most countries. It can be held in the name of an offshore company or trust so that it doesn’t legally belong to you.

Buy Real Estate Overseas

Real estate overseas can be another useful asset to hold. It’s not reportable on tax returns in most countries. As a tax minimization strategy it can be held by an offshore company. If the property is later sold at a profit the profits will accrue tax free in the offshore company.

Have Assets owned by a Foundation or Trust

One of the main tax minimization strategies pursued by the super-rich is to own nothing, but control everything. When you put assets in a trust or foundation, you are no longer the legal owner. That means that any income produced by those assets belongs to the trust or foundation. It doesn’t have to be reported on personal tax returns.

Use Overseas Bank Accounts

Offshore bank accounts can offer better returns than local bank accounts. Often the banks are more secure too. Offshore bank accounts in the name of your offshore company or trust do not have to be declared on your tax return. Even personal bank accounts outside your country can be advantageous. It’s much more difficult for authorities to seize money in foreign accounts. An offshore account is a great insurance policy against asset seizure, whether that be by government or through a lawsuit.

Take on Debt

Another strategy for tax minimisation is to keep assets in your home country highly leveraged. This works particularly well in a low interest rate environment where money is cheap. You can borrow cheaply against assets in your own country and invest overseas through your offshore company for a higher return. The profits earned in the offshore company will be tax free.

Borrow from Your Offshore Company and Trust

If you need to get money out of your offshore company there’s no need to take it as income. Have the company make a loan to you. It should be on full commercial terms at a market rate of interest. It should be fully documented. It can even be secured on assets in your own country. You have the benefit of using money from your offshore company without it being taxable. A loan from your offshore company can’t be taxed as it’s not income.

Have a Second Residency

You should have a legal second residency in a foreign country. As a tax minimisation strategy this will expand your options. When opening bank accounts overseas us your overseas residence card. In that way any information exchanged between countries about bank accounts will go to the country of your second residence and not your home country. If you choose the right country for a second residency, not only will it help with your tax minimisation plan, it’ll also lead to a second passport in the future.

FAQs

What is tax Minimisation?

Minimizing tax as opposed to tax avoidance is a strategy to legally reduce or eliminate your tax liability.

How can I legally minimize my taxes?

You can minimize your taxes by using offshore structures or relocating your main residence overseas. There are dozens of strategies to minimize taxes depending on your circumstances.

How do rich people avoid taxes?

The super rich like to own nothing but control everything. That’s to say, they will own assets through offshore companies and trusts. They will control assets but never appear as legal owners.

We help our clients to protect their assets and reduce their taxes legally. We solve difficult problems for our clients. Get in touch with us using the form below.