Are Gold and Silver Still Useful in the age of Crypto?

Precious metals have always been stores of value. Today, however, there’s more excitement about Bitcoin and other cryptocurrencies. While there’s no denying that cryptocurrencies have outperformed precious metals in the last decade it’s worth having a closer look at why precious metals have been used as money for more than 5,000 years. If you were forced to hold only one asset class for the next 100 years to preserve your wealth would you choose precious metals or cryptocurrency?

What is Money?

Money is a tool of exchange. A way to exchange a value you have for a value you want, without having to find a specific item that the seller of the item you want desires. Over the millennia, many things have been used as money. Animal skins, salt, and even shells have been used at one point in time.

It was not until gold and silver began to be used as money that coins were also used as a medium of exchange. Gold could not be counterfeited as easily. It was rare and could be easily exchanged for goods and services. When gold or silver was used as currency, inflation was unknown. Gold could not be created out of thin air, so there could be no inflation.

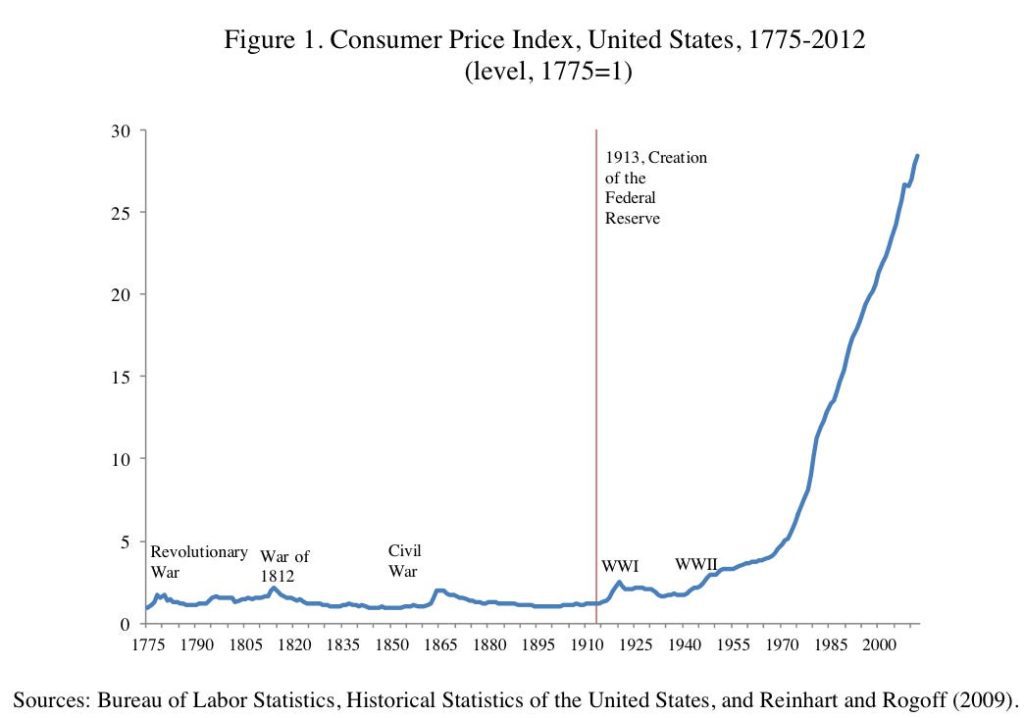

As we can see there was almost no inflation between 1775 and 1933. Inflation really took off in 1971 when the US ended the dollar’s convertibility to gold.

The Invention of Paper Money

Before there were banks as we know them today, there were bullion dealers who sold gold and silver. Bullion dealers also stored the gold and silver on behalf of their customers. When they stored the gold and silver, they issued a note that entitled the holder of the note to a certain amount of gold or silver. This made trading easier because the physical gold bars no longer had to be moved. You could pay for goods with a note and the seller could reuse that note to buy what they wanted and so on. Thus, paper money was born.

This system worked well for centuries. In fact, the US dollar is based on this system. Each dollar was equal to 1/20 of an ounce of gold. The British pound could be exchanged for one pound of silver.

Central Bank Interference With Sound Money

After World War I, central banks began to interfere with the sound monetary system. They created more money than they had gold in their reserves. The British pound was no longer convertible to silver from 1816, but the country remained on the gold standard until 1931 when it was forced to abandon it.

After World War II, the United States had replaced the United Kingdom in issuing the reserve currency of the world. This was at least partly due to its high-value monetary system. The US devalued the dollar in 1933. It was now worth 1/35 of an ounce of gold.

The US Confiscates Gold from Citizens

In April 1933, the US government attempted to confiscate all gold from private citizens. President Roosevelt issued an executive order on April 5, 1933, requiring all Americans to turn in their physical gold or gold certificates by May 1, 1933. It is not known to what extent this order was obeyed, but it is hard to imagine how it could have been enforced against anyone who kept a vault full of gold at home or in any place other than a bank or known gold vault.

That’s why it’s important to choose carefully the place where you store your gold. While it is not a good idea to keep it at your home or place of business, you should keep it under your own control and not under the control of a custodian. A bank or other custodian will comply with any court or government order to turn over your assets.

Sound Money Abandoned in 1971

The U.S. kept the dollar pegged to gold at the same price until 1971 when Nixon abandoned the gold standard entirely as foreign countries exchanged their dollars for gold. Since 1971, the dollar has lost more than 90% of its purchasing power.

Now governments only use counterfeit paper money that can be created out of thin air. This is only maintained by trust.

When you exchange your goods or services for dollars or euros, expect to be able to exchange those dollars or euros for goods of similar value. When this confidence eventually declines the current systems of paper money will collapse. It’s interesting to note that every paper currency that has ever existed has ended up being worth less than the paper it’s printed on.

You have the option of creating your own gold standard. There is nothing to prevent you from storing precious metals in a secure vault. This can be in your home country or in a trusted location in a safe haven like Singapore.

Those who have real money, safely stored will be secure in the knowledge that their assets are protected against arbitrary confiscation through inflation.